Social security windfall elimination calculator

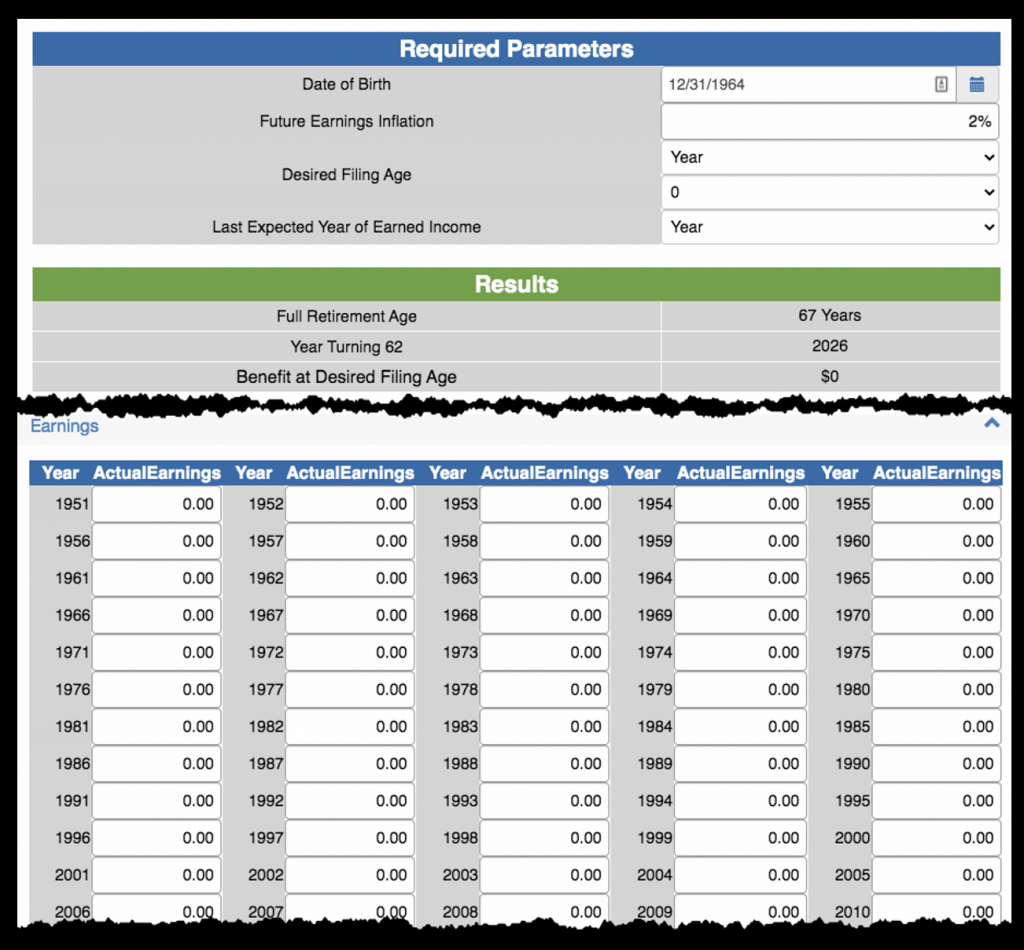

This is for a Windfall Elimination Provision WEP calculation which should be used only by people who have pensions from work not covered by Social Security. Next in the above example lets change the nonSS.

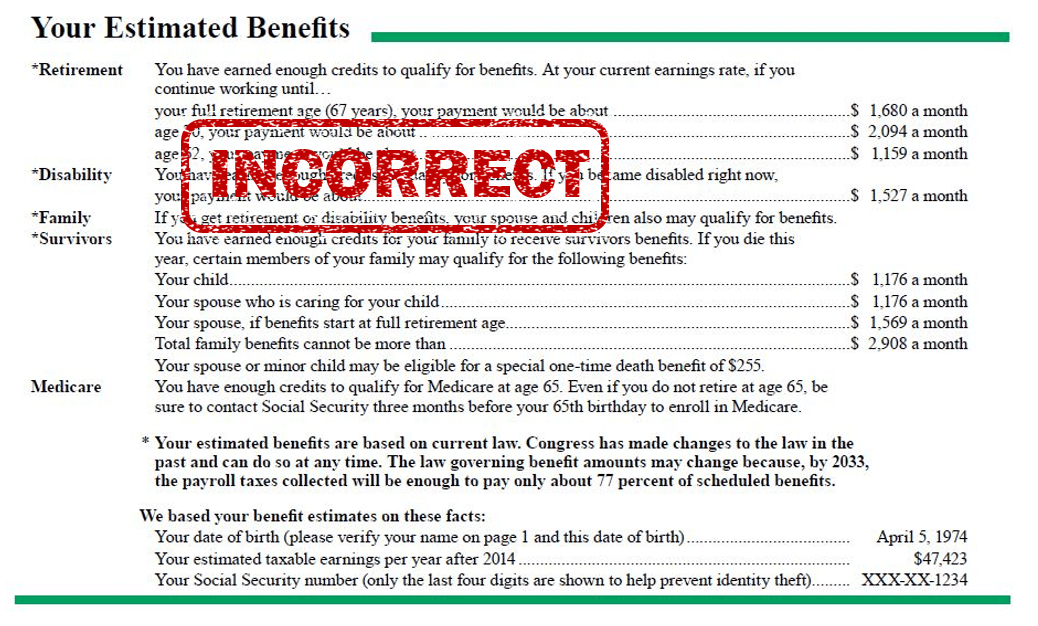

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

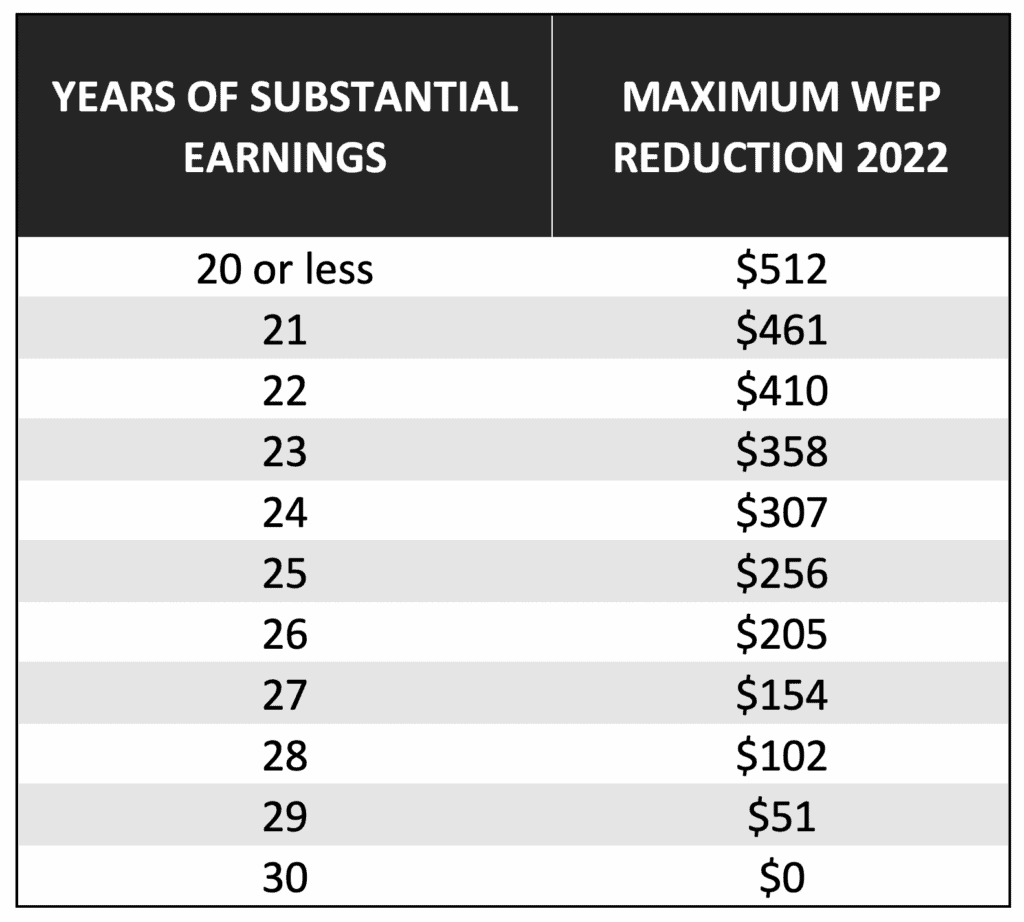

If you do not have 30 years of.

. Employer who didnt withhold Social Security taxes. If you turn 62 in 2022 ELY 2022 and you have 20 years of substantial. The Social Security WEP Calculator The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

You qualify for Social Security retirement or disability benefits from work in other jobs for which you did pay taxes. Its likely that your Social Security benefit will be reduced under the terms of a government rule called the Windfall Elimination Provision WEP. The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid.

The most your Social Security Benefit will be reduced with 20 years of substantial earnings in 2019 is 463. 444 556 of 800 396 250 50 of 500 So your WEP penalty is 250 which reduces your FRA SS benefit from 800 to 550. The amount of Social Security benefit you can expect.

The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. The Windfall Elimination Provision WEP is poorly understood and catches a lot of people by surprise.

35 rows Your age 62 retirement benefit is 618 884 x 70 618 per month. Who can use this app. Anyone who has paid into Social Security at some point in their career can use this app including those affected by the Windfall Elimination Provision.

If you turn 62 in 2022 ELY 2022 and you have 20 years of. 35 rows The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. Ad Get Your Proof Of Income Letter Online With a Free my.

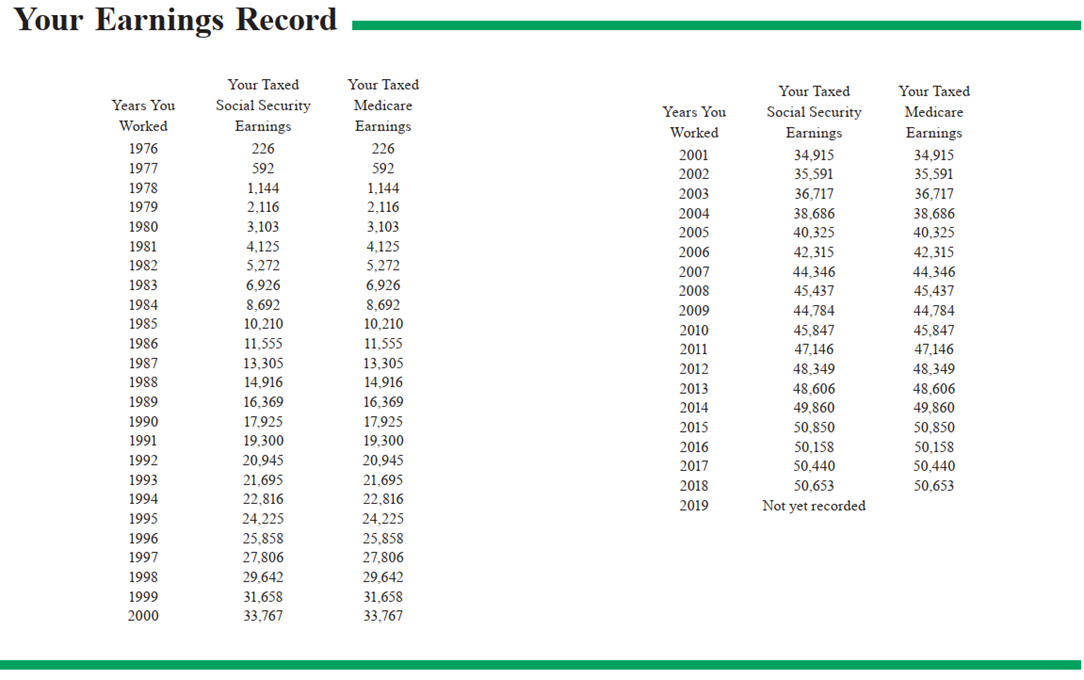

Social Security benefits are based on the workers average monthly earnings. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. This calculator will tell you.

Calculate the PIA using both covered and non-covered earnings with the normal non-WEP formula using. If you do not have a non. If you turn 62 in 2022 ELY 2022 and you have 20 years of substantial.

This entire PSP calculation would be accomplished by a simple two-step process.

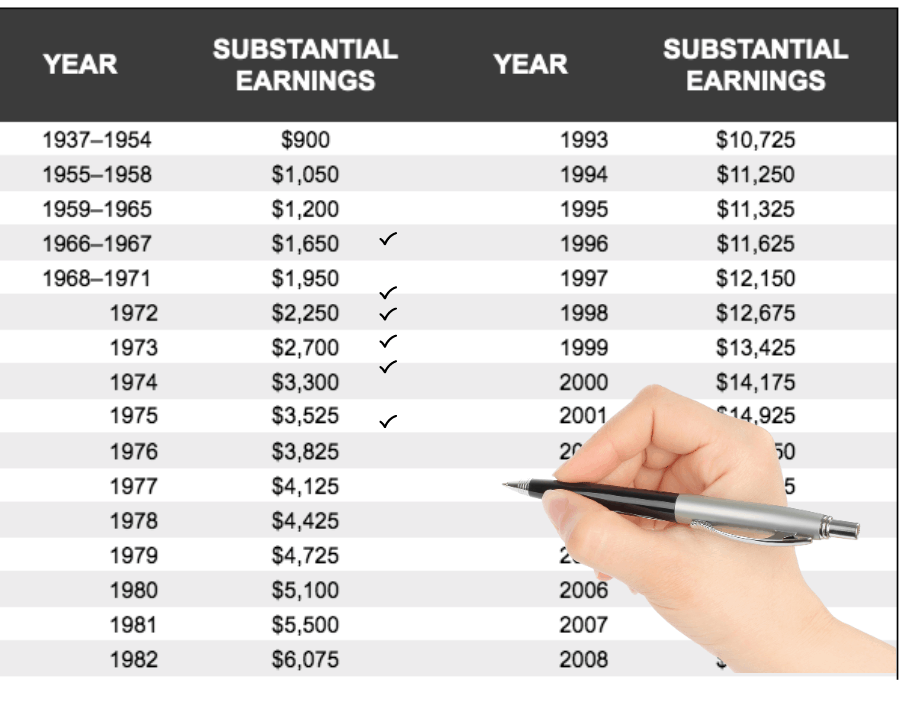

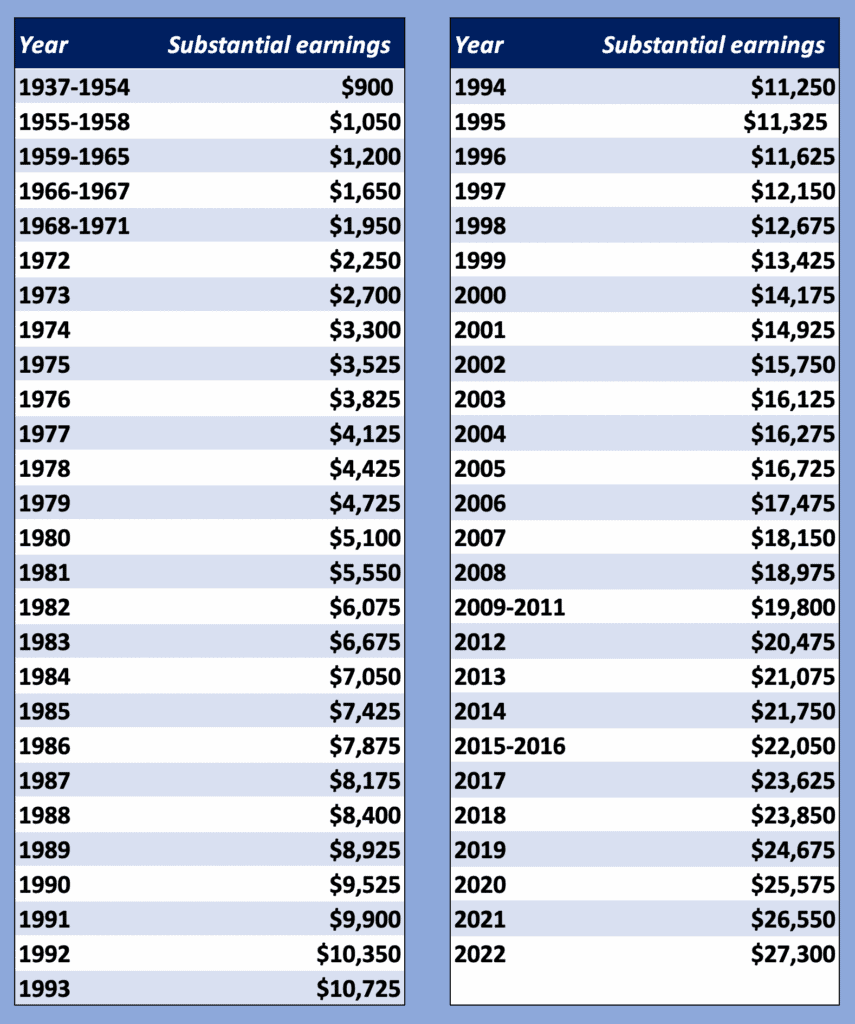

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

Social Security S Windfall Elimination Provision

How A Government Pension Might Reduce Your Social Security Benefits Vermont Maturity

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

How Wep Can Affect A Person S Social Security

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Windfall Elimination Provision Government Pension Offset Meld Financial

How The Social Security Windfall Elimination Provision Wep Impacts Pension Payments Carmichael Hill

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

If The Windfall Elimination Provision Reduces Your Social Security You May Be In Luck

Program Explainer Government Pension Offset

Wep Gpo Repeal Would Mean Earlier Insolvency For Social Security Committee For A Responsible Federal Budget

Social Security Sers

Calculators Social Security Intelligence

A Comprehensive Guide To Social Security After Divorce